Reverse Book building happens in the same manner as book building happens, the only difference is here the shareholders place their sell orders along with a bid ask price.

Cases that require to follow the Reverse Book building process:

When the promoters want to delist the company shares voluntarilyCases where the public shareholding in the company falls below the minimum limit specified in the listing conditions or listing agreement that may result in delisting of securities. Example: Take overs, mergers and acquisitions by which the majority shares of the company are acquired either by a promoter or by any other personCompulsory delisting resulting due to the orders by stock exchanges/SEBI.Cases where a promoter/a person in the management has sought to consolidate his holdings in the company in a manner affecting the public shareholding to fall down below minimum limit specified in the listing conditions or listing agreement.

Reverse Book building Process:

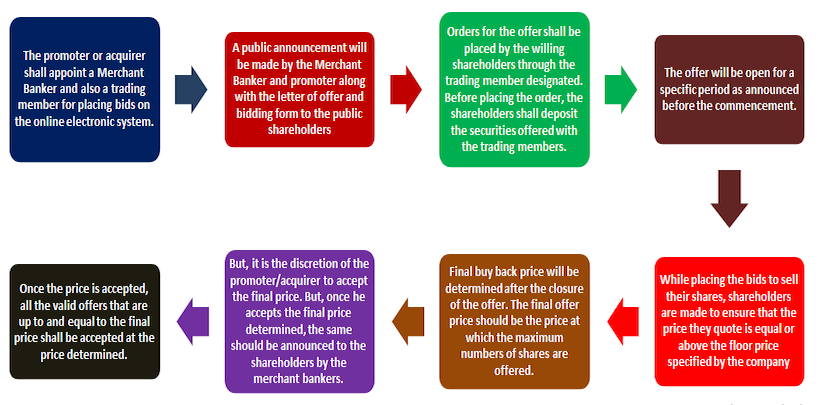

The promoter or acquirer shall appoint a Merchant Banker and also a trading member/broker for placing bids on the online electronic system.A public announcement will be made by the Merchant Banker and promoter along with the letter of offer and bidding form to the public shareholders.Orders for the offer shall be placed by the willing shareholders through the trading member designated. Before placing the order, the shareholders shall deposit the securities offered with the trading members.The offer will be open for a specific period as announced before the commencement.While placing the bids to sell their shares, shareholders are made to ensure that the price they quote is equal or above the floor price specified by the company.Final buy back price will be determined after the closure of the offer. The final offer price should be the price at which the maximum numbers of shares are offered.But, it is the discretion of the promoter/acquirer to accept the final price. But, once he accepts the final price determined, the same should be announced to the shareholders by the merchant bankers.Once the price is accepted, all the valid offers that are up to and equal to the final price shall be accepted at the price determined.

Failure of offer:

When the quantity eligible for acquiring securities at the final price offered does not make the promoter’s holding cross the limits specified in the SEBI’s Delisting Regulations, the offer shall be deemed to have failed and the company shall remain listed. A specific process has been incorporated in the SEBI Delisting regulations for small companies willing to delist their shares voluntarily. Recommended Articles

What are the ways in which an IPO can be initiated ??What is listing, its Importance and Benefits of listingSME IPO – BSE’s SME Exchange and NSE’s EmergeAre you an SME? Know your EligibilityWhat is IPO Grading?What does the Recognised Stock Exchange do ?Different Types of Orders Placed in Stock MarketDelisting of SharesEarnings Per Share (EPS)