Removal of Goods as Such – Excise Rules

As per CENVAT credit rules 2004 a manufacturer/service provider can avail the credit on input materials/services he used to manufacture/provide the output/service.

Rule 3(5) of CENVAT credit rules 2004:

This rule says that in the case of raw materials or machinery which are purchased with an intention of using in production and on which the CENVAT credit has already availed, are removed as such from the premises of the service provider or manufacturer then he is required to reverse or pay an amount equal to the CENVAT credit taken in respect of such materials and the removal should be under invoice.

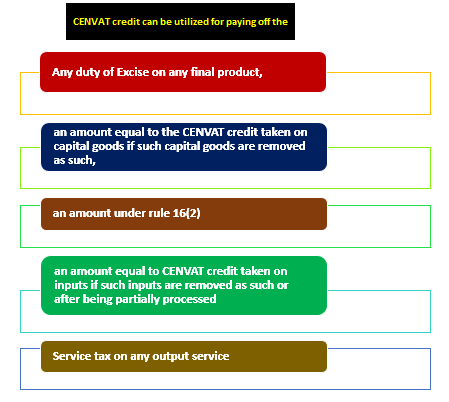

- If the raw materials are removed to outside the factory for the purpose of providing a warranty service to the final product then it is not required to reverse the CENVAT availed on the same. Rule 3(4) of the CENVAT credit rules says that : CENVAT credit can be utilized for paying off the

Classification of Excisable GoodsArrest and Bail Under Service Tax and Excise NotesDownload Latest Central Excise Forms – UpdatedAmendments in Cenvat Credit and Excise for Nov 2015

What if the manufacturer/ service provider removes the materials at a price higher than the purchase price? When a manufacturer sells the materials as such at a higher price than the purchase cost then he would ultimately charges excise on the transaction value which will be more than the CENVAT he availed on the same material. But the rule says that the exact amount equal to the credit availed if any on the as such cleared items should be reverses or paid off. But in this kind of cases the output tax charged would be higher than the CENVAT availed. Hence the difference between Output tax minus CENVAT availed on the materials should be paid to the government through PLA. Many companies having distinguished ERPs used to record the sale price at a higher than the purchase cost as if in the case of normal final products. In such instances excise duty will be charged by the system on invoice/ transaction value. Hence there would be certainly some difference left between the Output tax and the input taken. But this will be paid through normal CENVAT credit taken. But as per the rule said above this should be paid through PLA even there exist the CENVAT balance to be utilized.

What if in case of removal as such for exports?

When goods are removed as such for exports then there will be no obligation to reverse/pay the CENVAT credit. Illustration: M/s VRP pvt ltd engaged in manufacturing of cars and purchases various automobile parts for assembling the cars. On 03-02-2016 it has a balance of Rs 2000 CENVAT in its books. And removed some items the details are as such Purchase price Rs 10000 , selling price Rs 12000. Input credit taken on the same at 12.36%, Rs 1236. Excise duty collected on the sale is =12000*12.36% =1483. And the company wants to pay off this Rs 1483 by utilizing the balance in CENVAT. But this cannot be done as per the excise rules. Here the company has taken credit for Rs 1236. As per the above said rule it has to reverse the CENVAT credit taken ie 1236 and the balance =1483-1236 should be paid by way of bank/cash (PLA).