Recording and maintenance of register/ledgers on the common portal:-

NOTE: Any discrepancy in electronic liability register or electronic credit or cash ledger is to be communicated to the officer exercising jurisdiction in FORM GST PMT-04.

A. Electronic Liability Register: –

In terms of provisions of Section 49(7) of the CGST Act, 2017 read with Rule 1 of Payment of Tax Rules, all liabilities of a taxable person under this Act shall be recorded and maintained in an electronic liability register to be maintained in Form GST PMT-01. Significant notable points are: –

- All amounts payable shall be debited to this register.

- Debit to this register will be done for: –

i. Tax and other dues as per return;ii. Tax and other dues determined by proper officer;iii. Tax & interest due to mismatch;iv. Any interest.

- Credit to this register will be done by debiting electronic cash or credit ledger

- Sequence of discharging tax and other dues:

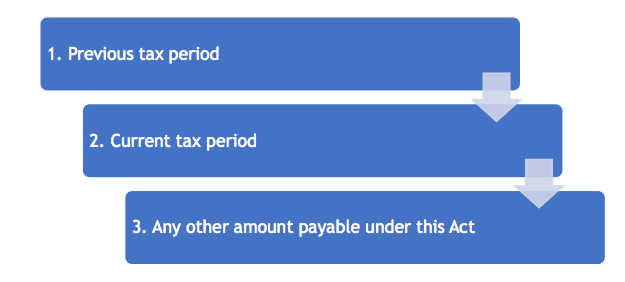

i. Previous tax periodii. Current tax periodiii. Any other amount payable under this Act.

Chart showing chronological order of discharge of tax and other dues – Electronic Liability Register

B. Electronic Credit Ledger: –

In terms of provisions of Section 49(2) of the CGST Act, 2017 read with Rule 2 of Payment of Tax Rules, the Input Tax Credit (ITC) as self-assessed in the return of a registered person shall be credited to his electronic credit ledger to be maintained in Form GST PMT-02. Significant notable points are: –

- Debit/credit entries: Entries in Electronic credit ledger shall be as under: –

i. Self-assessed ITC in the return as per Section 41 read with Section 49(2) shall be credited to the ledger.ii. Utilization towards output tax shall be debited to the ledger.iii. Unutilized amount in the Electronic Credit Ledger after payment of tax and other dues can be claimed as refund subject to the provisions of Section 54 of CGST Act, 2017 read with Refund Rules. Ledger shall be debited accordingly. If refund is rejected, then ledger shall be re-credited by proper officer by order in Form GST PMT-03.

- Sequence and restriction for the utilization of Input Tax Credit:- Note: Cross utilization of SGST & CGST & UTGST is not permissible

C. Electronic Cash Ledger

In terms of provisions of Section 49(1) of the CGST Act, 2017 read with Rule 3 of Payment of Tax Rules, every deposit made towards tax, interest, penalty, fee or any other amount by a person shall be credited to the electronic cash ledger to be maintained in Form GST PMT-05. Significant notable points are: –

1. Payment sources :

Payment can be made through following two modes: –

i. Online banking;ii. Over the counter (OTC)

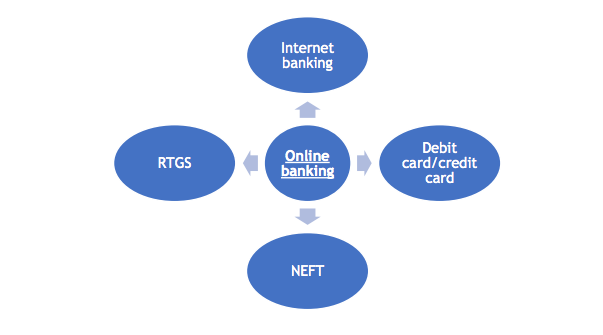

i. Online banking:-

Payment of GST by taxpayer can be made through four online modes: –

Internet bankingDebit card/Credit cardNEFTRTGS

ii. Over The Counter (OTC):-

OTC up to Rs. 10,000/- is permitted per challan per tax period by cash/cheque/DD.

2. Payment procedure:

i. Challan to be generated in FORM GST PMT – 06 for the tax, interest, etc. to be deposited (Valid for 15 days).ii. Payment by non-registered person shall be made on the basis of temporary identification no.iii. Mandate form (Applicable in case of NEFT and RTGS): Where the payment is made by way of NEFT or RTGS mode, the mandate form shall be generated along with the challan on the Common Portal and the same shall be submitted to the bank from where the payment is to be made (The said mandate form will be valid for 15 days from the date of generation of challan).iv. On successful payment, a Challan Identification Number (CIN) will be generated and the same shall be indicated in the challan. On receipt of CIN from the authorized Bank, the said amount shall be credited to the electronic cash ledger. But if CIN is not generated or not communicated, person may represent in FORM GST PMT – 07 to bank/electronic gateway.

3. Debit/credit entries in Electronic cash ledger in Form GST PMT-05

Following transactions shall have an effect on the electronic cash ledger and shall be debited/ credited accordingly: –

i. Self-payment shall be credited to the ledger;ii. TDS or TCS to be credited to electronic cash ledger of the person from whom the amount was deducted or collected;iii. Payment towards tax, interest, penalty, fee or any other amount shall be debited to the ledger.iv. Balance in Electronic cash ledger after payment of tax and other dues can be claimed as refund. Amount claimed as refund to be debited to the ledger. If refund is rejected, ledger to be re-credited by proper officer by order in Form GST PMT-03;

Note: TDS, TCS, tax under reverse charge and tax in case of composition levy can be made by debiting electronic cash ledger only

II. Payments under GST – Interest on delayed payment of tax (Section 50)

Where payment under GST is not made within the prescribed time, registered taxable person shall pay interest for such delay as under:-

III. Tax deduction at source (Section 51)

These provisions are applicable for tax deduction when goods/services are supplied to Department or establishment of CG or SG, local authority or Govt. agencies. Details are in the below table: –

IV. Collection of tax at source (Section 52)

These provisions are applicable when supplies are made through an electronic commerce operator. Details are in the below table: –

V. Summary of Forms under Payment provisions

Recommended Articles

GST ScopeGST ReturnGST FormsGST RateGST RegistrationWhat is GST?GST Invoice FormatGST Composition SchemeHSN CodeGST LoginGST RulesGST StatusTrack GST ARNTime of Supply