Section 122 to 131 contained in Chapter XIX of CGST Act, 2017 makes provisions relating to offfence and penalties. Summary of therse provisions are as follows:

What is an offence?

An offence is a breach of a law or rule, i.e., an illegal act. Similarly, an offence under GST is a breach of the provisions of GST Act and GST Rules. The following would constitute offences under the Act.

a) Any mis-declaration in respect of the goods vis-à-vis its value or description or weight or originb) Violation of allied acts, example, Violation of wild life, Drug & Cosmetics Act, Food laws etc.c) Landing of Goods at unauthorised ports

Such offences could result in civil or criminal liabilities or both and both could run simultaneously. Criminal prosecution could result in imprisonment + fines, and civil prosecution could result in alienation of wealth and penalties.

Criminal Liabilities

Punishment up to 7 yearsOffences involving duty evasion of more than INR 50 Lakhs, or prohibited goods, are non-bailableFraudulent duty drawback claims, exceeding INR 50 Lakhs is also non bailable

Civil Liabilities

Recovery of duties short paidInterest chargePenaltiesConfiscation of import / export goodsConfiscation of conveyances used for smugglingUp to 200% duty for unaccounted goodsUp to 5 times the value of goods for forged documents

The normal limit for the above prosecution is one year, whereas for intended fraud, the time limit is 5 years.

When has anyone committed an offence under GST?

There are 21 offences under GST. For easy understanding, we have grouped them as- Fake/wrong invoices

A taxable person supplies any goods/services without any invoice or issues a false invoice.He issues any invoice or bill without supply of goods/services in violation of the provisions of GSTHe issues invoices using the identification number of another bonafide taxable person

Fraud

He submits false information while registering under GSTHe submits fake financial records/documents or files fake returns to evade taxDoes not provide information/gives false information during proceedings

Tax evasion

He collects any GST but does not submit it to the government within 3 monthsEven if he collects any GST in contravention of provisions, he still has to deposit it to the government within 3 months. Failure to do so will be an offence under GST.He obtains refund of any CGST/SGST by fraud.He takes and/or utilizes input tax credit without actual receipt of goods and/or servicesHe deliberately suppresses his sales to evade tax

Supply/transport of goods

He transports goods without proper documentsSupplies/transports goods which he knows will be confiscatedDestroys/tampers goods which have been seized

Others

He has not registered under GST although he is required to by lawHe does not deduct TDS or deducts less amount where applicable.He does not collect TCS or collects less amount where applicable.Being an Input Service Distributor, he takes or distributes input tax credit in violation of the rulesHe obstructs the proper officer during his duty (for example, he hinders the officer during the audit by tax authorities)He does not maintain all the books that he required to maintain by lawHe destroys any evidence

Offences under GST by Companies, LLPs, HUFs and others

For any offence committed by a company, both the officer in charge (such as director, manager, secretary) as well as the company will be held liable. For LLPs, HUFs, trust, the partner/karta/managing trustee will be held liable. Read our article on liability to pay unpaid gst dues in certain cases.

What does penalty mean?

In the GST regime, there is uniform penalty and prosecution provision for similar type of offence that may committed by a registered person, depending upon its severity. The word “penalty” has not been defined in the CGST Act but judicial pronouncements and principles of jurisprudence have laid down the nature of a penalty as:

a temporary punishment or a sum of money imposed by statute, to be paid as punishment for the commission of a certain offence;a punishment imposed by law or contract for doing or failing to do something that was the duty of a party to do.

‘Prosecution’ is the institution or commencement of legal proceeding; the process of exhibiting formal charges against the offender. Section 198 of the Criminal Procedure Code defines “prosecution” as the institution and carrying on of the legal proceedings against a person.

Common Offences Under GST And Their Penalties

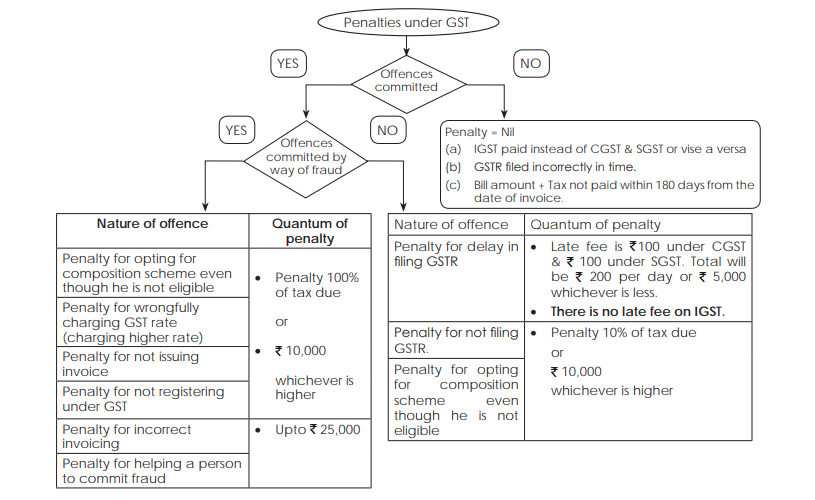

Situations where there is no penalty (but interest may apply)

Penalty in cases of fraud

An offender has to pay a penalty amount of tax evaded/short deducted etc., i.e., 100% penalty, subject to a minimum of Rs. 10,000. (High value fraud cases also have jail term)

Fraud case

Penalty 100% of tax due or Rs. 10,000 whichever is higher

Non-fraud case

Penalty 10% of tax due or Rs. 10,000 whichever is higher For the 21 offences above, for fraud cases, penalty will be 100% (minimum Rs. 10,000).

What is the penalty for helping someone to commit fraud under GST?

Not only the taxable person but any person who does the following will have to pay a penalty extending upto Rs. 25,000

Helps any person to commit fraud under GSTAcquires/receives any goods/services with full knowledge that it is in violation of GST rulesFails to appear before the tax authority on receiving a summonsFails to issue an invoice according to GST rulesFails to account/vouch any invoice appearing in the books

Are there any jail punishments?

Yes, GST has corporal punishments (jail) for high value fraud cases as follows- These punishments are applicable along with monetary penalty. For more details please read our article on prosecution.

Penalty for Other Cases (no intention of fraud or tax evasion)

An offender not paying tax or making short-payments has to pay a penalty of 10% of the tax amount due, subject to a minimum of Rs.10,000. Therefore, the penalty will be high at 100% of the tax amount when the offender has evaded i.e., where there is a deliberate fraud. For other non-fraud cases, the penalty is 10% of tax.

General Penalty (Section 125)

Any person, who contravenes any of the provisions of this Act or any rules made thereunder for which no penalty is separately provided for in this Act, shall be liable to a penalty which may extend to twenty-five thousand rupees.