What Is a Personal Finance, And How Does It Work

Personal finance is a plan that considers your current financial situation and future goals and creates a strategy for spending, saving, and investing that can help you achieve your financial goals. There are many different components to a personal finance plan, but the most important elements are your income, your debts, your expenses, and your goals. Your income is the money you have coming in each month, from employment, investments, or other sources. Your debts are the money you owe to others, including credit card debt, student loans, money apps like dave, and mortgages. Your expenses are the regular payments you make to cover your cost of living, including rent or mortgage payments, utility bills, and food costs. And finally, your goals are the things you hope to achieve with your personal finance plan, such as buying a home, saving for retirement, or paying off debt. By taking all of these factors into account, you can create a personalized plan that will help you meet your financial goals.

Why Is Personal Finance Important

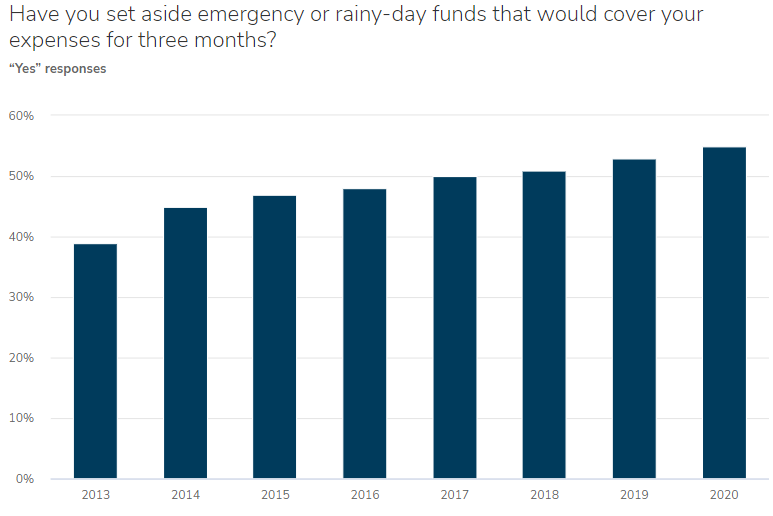

According to a recent survey, four in ten Americans say they would have difficulty covering an unexpected $400 expense. This statistic is alarming, but not surprising. For many people, personal finance is a mystery. They don’t know how to save money or invest for the future. As a result, they are unprepared for unexpected expenses, retirement, and the other financial challenges that life throws their way. Personal finance is important because it gives people the ability to take control of their financial future. Those who understand personal finance are able to save for retirement, build an emergency fund, and make smart investments. In addition, they are less likely to fall victim to predatory lending practices and other financial scams. Ultimately, personal finance is about giving people the tools they need to secure their financial future.

Examples of Personal Finance in Everyday Life

It’s no secret that personal finance can be a tricky subject. From budgeting to investing, there are a lot of different concepts to understand. However, personal finance is also an important part of everyday life. Here are just a few examples of how personal finance affects people on a day-to-day basis:

- When you go to the grocery store, you’re making decisions about how to spend your money. Do you buy the cheaper generic brands, or do you splurge on the name-brand items?

- When you’re choosing a new car, you’re considering factors like interest rates, insurance costs, and fuel efficiency. All of these things have a direct impact on your finances.

- Even simple things like choosing a cell phone plan can be affected by personal finance considerations. Do you want the cheapest plan possible, or are you willing to pay more for features like unlimited data?

- When you’re planning for retirement, you’re essentially doing long-term financial planning. You’re thinking about how much money you’ll need to save in order to maintain your lifestyle after you stop working.

- And when you file your taxes each year, you’re again dealing with financial concepts like deductions and credits. As you can see, personal finance is a part of almost every aspect of your life. By understanding the basics of personal finance, you can make better decisions about how to spend and save your money.

What Are Some Common Myths About Personal Finance?

Despite its importance, there is still a lot of misinformation out there when it comes to personal finance. Here are a few of the most common myths about personal finance:

Myth #1 Personal Finance Is Too Complicated for Me to Understand

Reality: Anyone can learn the basics of personal finance. There are plenty of resources available, including books, websites, and even classes. And once you understand the basics, you’ll be better equipped to make financial decisions that are right for you.

Myth #2 I Don’t Make Enough Money to Save

Reality: It doesn’t matter how much money you make. Everyone can save money by making small changes to their spending habits. For example, you could start bringing your lunch to work instead of buying it. Or you could cut back on your cable TV package.

Myth #3 I Don’t Need to Worry About Personal Finance Until I’m Older

Reality: It’s never too early to start thinking about personal finance. The sooner you start, the more time you’ll have to save and invest for the future. In addition, by understanding personal finance now, you’ll be better prepared to make financial decisions later on in life.

Myth #4 Personal Finance Is Only for Rich People

Reality: Personal finance is important for everyone, regardless of income. Everyone needs to understand how to budget, save, and invest for the future.

What Are Some Tips for Managing Personal Finances?

Now that you understand the basics of personal finance, here are a few tips to help you manage your finances:

Create a Budget

A budget is a tool that can help you track your spending and stick to a financial plan. There are many different ways to create a budget, so find one that works for you.

Save Money

It’s important to have savings for unexpected expenses and goals. Try to create a savings plan that allows you to automatically transfer a fixed amount of money into your savings account each month.

Invest Money

Investing is a way to grow your money over time. When you invest, you’re essentially putting your money into something that has the potential to increase in value.

Be Mindful of Debt

Debt can be a tool to help you reach your financial goals, but it’s important to use it wisely. Make sure you understand the terms of any loans you take out, and only borrow what you can afford to pay back. By following these tips, you can take control of your finances and make better decisions about your money. Personal finance doesn’t have to be complicated or overwhelming. By taking the time to learn the basics, you can make financial choices that are right for you.

The Bottom Line

Personal finance is a critical life skill that everyone should learn. By understanding the basics of personal finance, you can make better decisions about how to spend and save your money. There are many resources available to help you learn about personal finance, so don’t be afraid to get started today.