If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

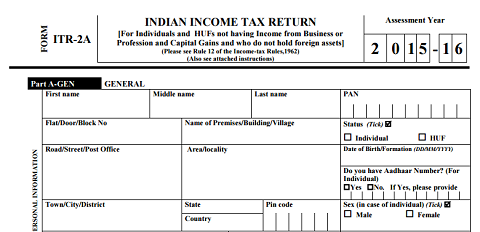

ITR 2A Download For AY 2016-17, Applicability of ITR 2A

Who can use this Return Form?

This newly introduced return form can be used by the individuals/ HUFs whose total income includes the following: (a)Income from salary/ Pension (b)Income from house property (c)Income from other sources (including winning from lottery and income from race horses) Further, in a case where the income of another person like spouse, minor child, etc. is to be clubbed with the income of the assessee, this Return Form can be used where such income falls in any of the above categories

Who can not use this Return Form?

This Return Form should not be used by an individual/HUF whose total income for the assessment year 2016-17 includes:-

Income from capital gains; orIncome from Business or Profession; orAny claim of relief/deduction under section 90/90A/91; orAny resident having any asset (including financial interest in any entity) located outside India or signing authority in any account located outside India; orAny Resident having Income from any source outside India.

New ITR 2 Return Form is applicable for assessment year 2015-16 only, i.e., it relates to income earned in Financial Year 2014-15.

Annexure-less Return Form

No document (including TDS certificate) should be attached to this Return Form. All such documents enclosed with this Return Form will be detached and returned to the person filing the return.

Manner of filing this Return Form

This Return Form can be filed with the Income-tax Department in any of the following ways, – From the assessment year 2015-16 onwards any assessee (other than an individual of the age of 80 years or more at any time during the previous year) having a refund claim in the return or having total income of more than five lakh rupees is required to furnish the return in the manner provided at 5(ii) or 5(iii) or 5(iv). Where the Return Form is furnished in the manner mentioned at 5(iv), the assessee should print out two copies of Form ITR-V. One copy of ITR-V, duly signed by the assessee, has to be sent by ordinary post to Post Bag No. 1, Electronic City Office, Bengaluru–560100 (Karnataka). The other copy may be retained by the assessee for his record.

Filling out the acknowledgement

Only one copy of this Return Form is required to be filed. Where the Return Form is furnished in the manner mentioned at 5(i), the acknowledgement should be duly filled in ITR-V.

Verification

(a) In case the return is to be furnished in a paper format or electronically under digital signature or in a bar coded return format, please fill up the required information in the Verification. Strike out whatever is not applicable. Please ensure that the verification has been signed before furnishing the return. Write the designation of the person signing the return. (b) In case the return is to be furnished electronically in the manner mentioned in instruction no. 5(iv), please fill verification form (Form ITR-V) (c) Please note that any person making a false statement in the return or the accompanying schedules shall be liable to be prosecuted under section 277 of the Income-tax Act, 1961 and on conviction be punishable under that section with rigorous imprisonment and with fine.

Download ITR 2A Form for AY 2016-17 or FY 2015-16

Not Available at this time, we expect that income tax department issued ITR Forms for AY 2016 17 In the Month of April 2016, Keep visit to our site for more latest updated related to ITR Forms for 2016-17

Download ITR 2A Form for AY 2015-16 or FY 2014-15

Recommended Articles

ITR – 1 SAHAJ – DownloadLatest Income Tax Return (ITR) FormsForm 3CA 3CB 3CD In Word Excel & Java FormatLatest Income Tax Slab RatesProcedure For E-Filling of Tax Audit ReportIncome Tax Due Datesincometaxefiling