We discussed earlier various heads under GSTR-1 and GSTR-2. GSTR-1 requires to furnish details of outward supplies of taxable goods and services by registered taxable supplier. Similarly, GSTR-2 mandates furnishing details of inward supply or purchases in simple words. Here we are discussing various heads and their information source under GSTR-3. The following persons are not required to file the GSTR-3 return:

Registered taxable person paying taxes under Composition scheme (Form GSTR-4 shall be furnished instead)Non-resident taxable person (Form GSTR-5 shall be furnished instead)Person liable to deduct tax at source as per Section 46 (Form GSTR-7 shall be furnished instead, for the purpose of reporting the taxes deducted at source)Person liable to deduct tax at source as per Section 56 (Form GSTR-8 shall be furnished instead, for the purpose of reporting the taxes collected at source)

The return in GSTR-3 is auto populated from Forms GSTR-1 and GSTR-2. Further, the details of tax, interest and penalty paid have to be reported in Part B of Form GSTR-3. The return has to be filed by 20th of the succeeding tax period.

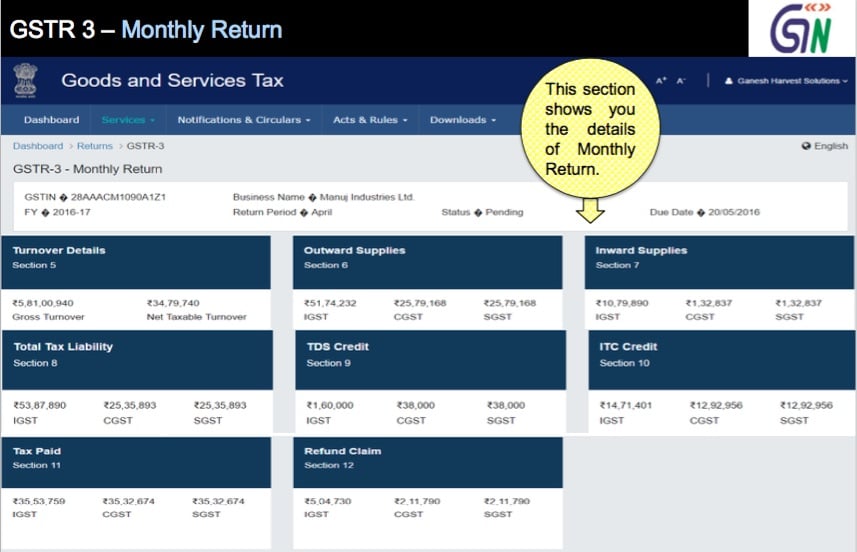

GSTR 3 – Monthly return after finalization of outward supplies and inward suppliesDue Date – 20th of succeeding tax period

Headings under GSTR-3:

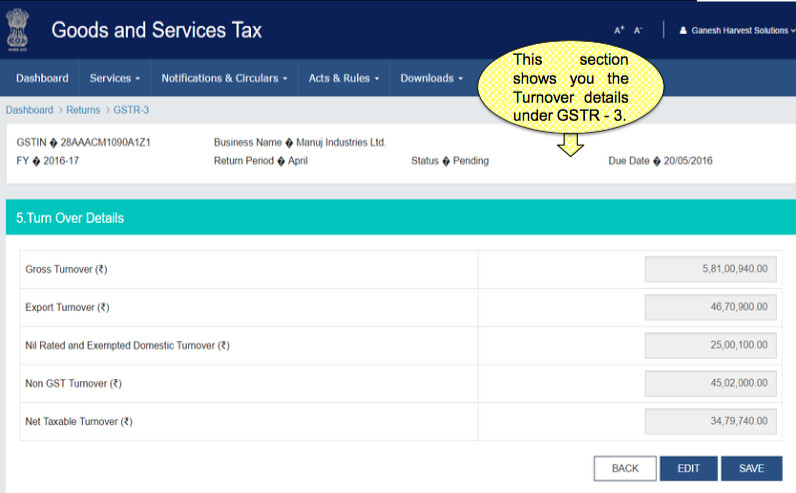

GSTIN: GST Number (GSTIN) is a unique 15 digit number which is allotted to the assessee at the time of filing an application for registration for Goods & Service Tax. Each taxpayer will be allotted a state-wise PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN). Just like PAN Card No is required for payment and filing of Income Tax Returns, similarly GSTIN is required for payment and filing of GST Returns.. The GSTIN of the taxpayer will be auto-populated at the time of return filing. Name of the taxpayer: Name of the taxpayer will also be auto-populated at the time of logging at the GST Portal. Address – Business address of the registered taxable person will get auto-populated here. Period: (Month -Year) – A Taxable person is required to select from a drop down the relevant month and year respectively for which GSTR-3 is being filed. Turnover: This heading will include consolidated turnover of all types of supplies. Gross turnover needs to be bifurcated between:

Following are my views on GSTR 3 Monthly Return

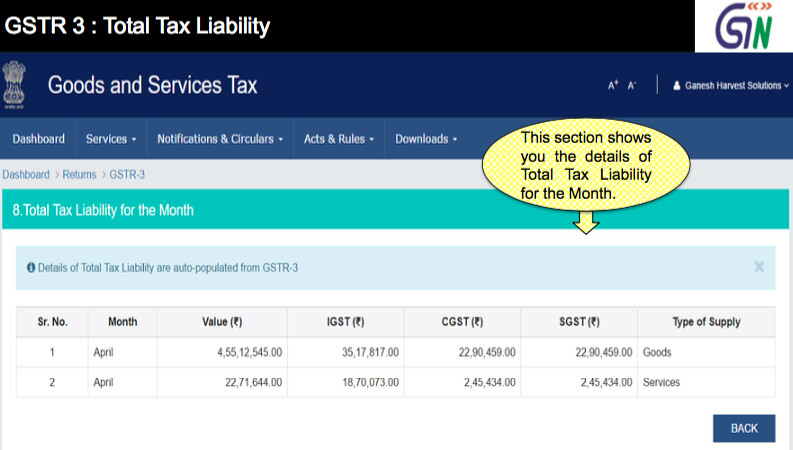

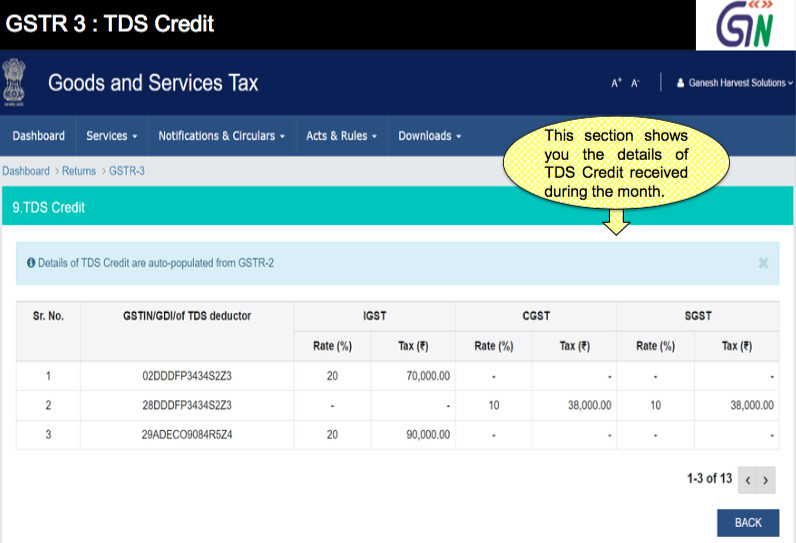

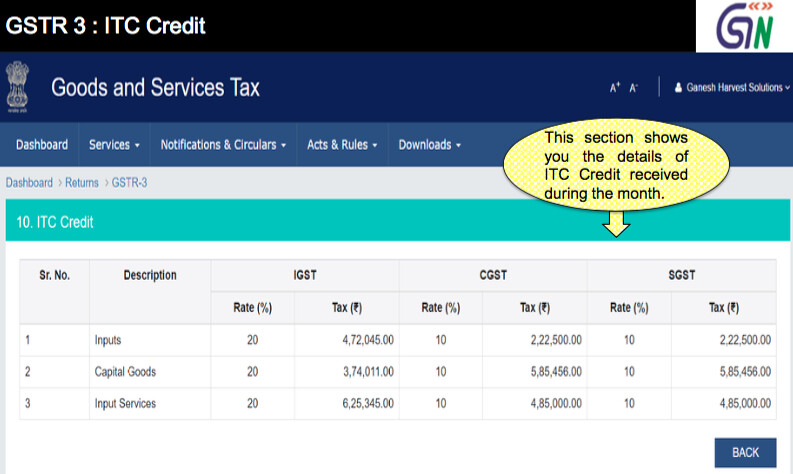

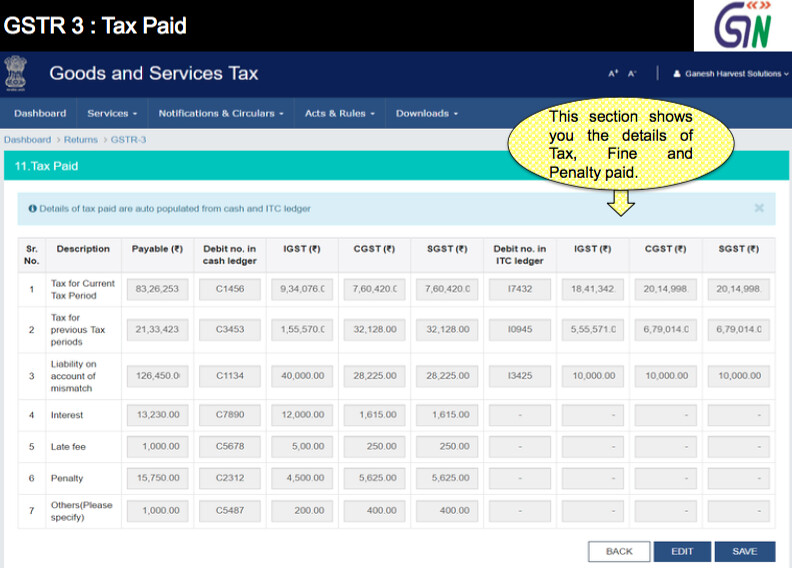

Provision to give total turnover separately for Taxable Turnover, Export Turnover, Nil rated and Exempted Turnover, Non GST TurnoverMost of the information of outward supplies and inward supplies are auto populated based on GSTR -1 & GSTR -2Provision for Output tax added / reduced on account of non-rectification / rectification of communicated mismatchesProvision for Total tax liability for the month for goods & Services separatelyProvision for ITC received during the month, mainly from electronic ITC ledgerAuto populated Tax, interest, late fee and penalty paid from Electronic cash ledger and ITC ledgerProvision for Refunds claimed from cash ledger

How to File GSTR 3 at GST Portal, Components of GSTR-3

Step 1 : A taxpayer require to login at GST Portal by using his user ID & Password Step 2 : After Successfully login, user can see his dashboard Step 3 : Now click on “Service Menu” and then click on Returns and then click on GSTR 2 – Now you will reach at GST Returns Page This section shows all the services available on the GST portal. You can select one to proceed further.

GST Monthly Return Filing Process

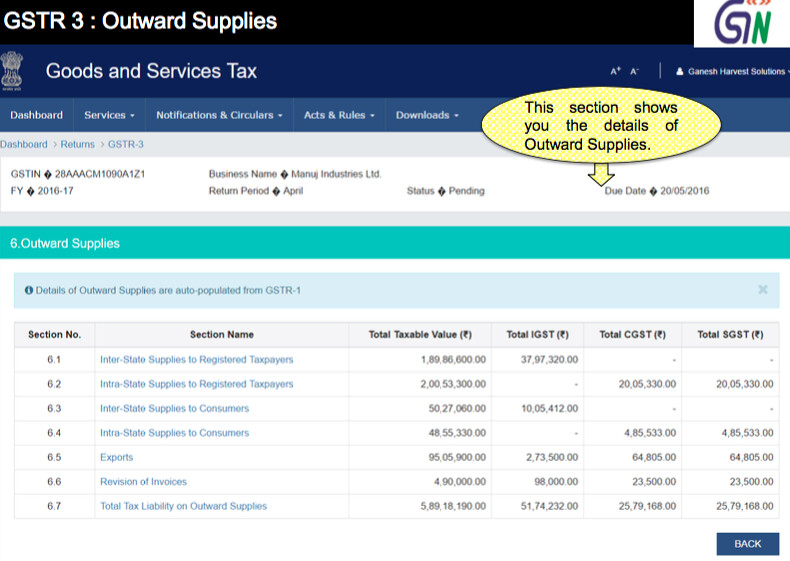

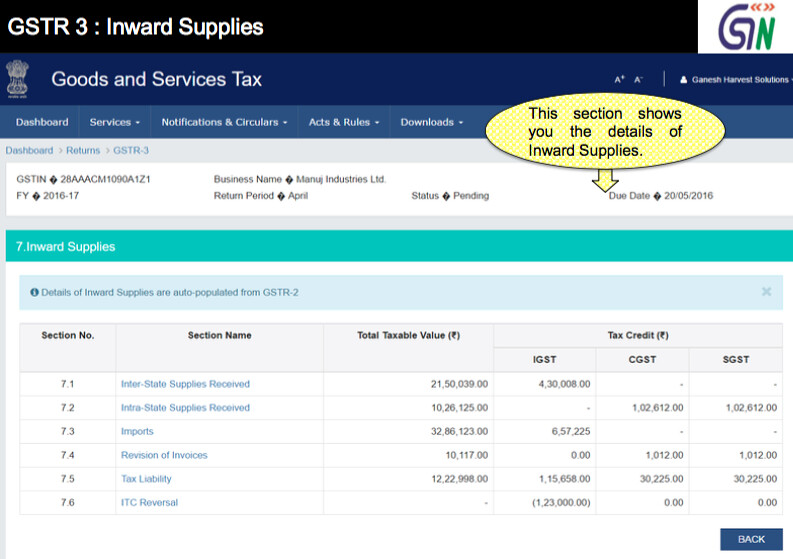

Here below you may find detailed process for how to file GSTR 3 Return, find complete details for GST Return process at GST Portal with screenshots. Now check more details from below…. GSTR 3 : Turnover Details – This section shows you the Turnover details under GSTR 3 GSTR 3 : Outward Supplies – This section shows you the details of Outward Supplies GSTR 3 : Inward Supplies – This section shows you the details of Inward Supplies GSTR 3 : Total Tax Liability – This section shows you the details of Total Tax Liability for the Month. GSTR 3 : TDS Credit – This section shows you the details of TDS Credit received during the month. GSTR 3 : ITC Credit – This section shows you the details of ITC Credit received during the month. GSTR 3 : Tax Paid – This section shows you the details of Tax, Fine and Penalty paid. GSTR 3 : Refund Claim – This section shows you Refund claims of excess ITC in specified cases and refund / adjustment of excess paid earlier.

Part B of Form GSTR 3

Tax, Interest, Late Fee and Penalty Paid – This heading will take input from all the headings from Part A and will determine the final GST liability. Separate tax liability will be shown against CGST, SGST, and IGST. Here the taxpayer will have the option to debit cash ledger/ credit ledger against the liability outstanding.Refunds Claimed from Cash Ledger – Input Credit amount in excess of tax liability will flow to this heading. The taxpayer can claim a refund of amount showing in this header.

Recommended Articles

GST RateGST Registration StatusGST LoginHow to Register and Update DSC on GST PortalGST RegistrationGST FormsHSN Code ListITC under GSTGST Due DatesTax Payment in GSTGST RefundPlace of Supply under GSTReturns Under GSTGSTR 1 Return Checklist