GST on Marriage Occasion

In the present market economy it has taken the shape of a big commercial activity which involves combination of both ‘mixed and composite’ supplies as described below:

Wedding planners,Designer clothes, suiting & shirtingGold, Diamond and othersCatering, sweets, fruits and dry fruitsDecorations, floristsmassive shopping of households which include Clothe, garments, utensils, furniture, electronic gadgets, cars, bikes/scooters/cycles and so on.Videographer, photography and pre-wedding photo shootsMusic parties, artists, dancers and band troopsBridal Makeup, Mehndi (Henna)Invitation Card, PrintingTransport,Hotels, Guest Houses and marriage palacesDestinations marriages

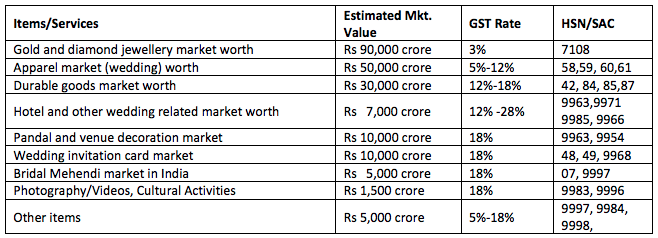

As per one estimate around 10-12 million marriages are being organized in India every year and on an average 200-500 guests per marriage are invited. Demographically, India is set to become the youngest country in the world by 2020, with a median age of 29 years. This demographic dividend would give a boost to the wedding industry as majority people marry in India between 21- 30 years of age. Estimates show that marriage Industry is growing at an average rate of 25% per year. In India, in wedding celebrations everyone spends beyond his/her capacity without thinking about any returns. Every manufacturer, retailer and service provider, dealing in marriage related goods or services eagerly wait for the wedding season. Three decades ago people hardly thought about the lavish wedding function that has now become a trend and may be a compulsion under social pressure. With each passing day the Indian weddings are being organized with great pump and show and budgets are showing upward trend accompanied by evils like unnecessary competition, show off, wastage of food, dowry, traffic hazards and litigation. Keeping aside all arguments everyone looks forward to be a part of it. As per rough estimates, the statistics of wedding market in India are as under:

Item-wise average expenses on Indian weddings are:

Liquor license fee, cost of liquor and related services and cost of petrol/diesel are separate and not included in it. Security guards, wallet car parking, Marriage resorts, exotic beach marriages, live telecast of marriage, drone camera, hiring choppers, limousines etc. are new add on features to the Indian marriage functions.

Destination Wedding Cost:

Favorite honeymoon destinations are Goa, Jaipur, Udaipur, Himachal and South On an average 30 to 40 grams of gold is gifted by parents or relatives in every marriage across the country, thus the total consumption of gold comes between 300 to 400 tonnes annually. It is also expected that the per capita income will be tripled in a couple of decades and the per capita consumption of gold during weddings or otherwise will increase. With half of India’s population being under 29 years of age, the marriage market is set to boom like never before over the next five to ten years. One estimate says that an Indian spends one fifth of the wealth accumulated in a lifetime on a wedding ceremony. That means, a tremendous opportunity for business players is there to capitalize on marriages. Online portals like Shadi.com, Bharat matrimonial etc. and others rack up revenues of Rs. 300-350 crore from match-making annually, and they are of the view that it will go further. While the traditional tentwallas still rule the market, the creative wedding planners are also making the most of it. They make all arrangements required for a wedding, from beginning to end, for a good professional fee. Every stakeholder from entertainment to décor, beauty clinics, cosmetic giants, travel, tourism, event managers, hotels and even matrimonial web sites are making good money out of marriages. There are budget planners also, who cater to the needs of the middle class of the country. Now a days, NRIs and foreigners also contribute a lot to boost up marriage industry in India. Recent trends show that Indian weddings are getting bigger thus offering better lucrative business opportunity to all players involved. These business players offer a blend of modern technology with traditional touch and make the marriages arrangements more attractive and enjoyable. Marriages being a subject matter of love and affection, emotions, social need and self respect make it a recession proof industry. Most of the activities in marriage are performed with human interface hence create jobs for both skilled and unskilled people. It’s one of the biggest contributors to the GDP of the country. Considering the size of marriages and arrangements needed, it’s a big project for a family and need good management and coordination. With more and more awareness and high paying capacity of people, especially the young brigade, everyone wants value for money and hire professional services to make it memorable. As mentioned earlier, goods and services required at marriage are combination of both ‘mixed and composite’ supplies. Such supplies are subject to GST and introduction of GST has made marriages costly by 10-15%. Tax on gold and diamond has gone up from 1.6% in pre-GST regime to 3% and on labor charges of ornaments, GST is 5%. Similarly, on other services tax has gone up by 3% from 15% to 18%. As per the activities listed above, most of the services are subject to GST @ 18%. A few are in the category of 28%, 12%, 5% and 3%. If the size of the industry is Rs. two lakh crore than minimum estimated revenue from the marriage activities is Rs. 25,000/- crore which will increase further if we get absolute data of the industry. GST rates as applicable to above said services are as under: As this industry is growing @ 25% per annum, GST will also increase in the same proportion. At present many service providers are working in an unorganized sector but the way industry is growing every year, all these service providers has to come under GST ambit and revenue of the government will increase. It is also a fact that marriages performed in remote parts of the country remain unaccounted. Otherwise this size will increase further. All the marriages do not have a happy ending. According to an estimate 13 out of 1000 marriages in India end up in divorce because of varied reasons adding to demand of legal services. Though these services are not subject to GST but indirectly contribute to exchequer kitty. Keeping in view everything, it is always advisable to plan your marriage wisely to enjoy maximum return in the form of happiness, charm and joy for the taxes paid on marriage function. Neither we nor government will gain from a ill-fated policies. There is a need to balance everything in market so that economy grows with our emotions, sentiments, traditions, rich culture, celebrations and taste of India as both are complementary to each other. “King must collect taxes like honey bee, it should be enough to sustain but not too much to destroy.” Chanakya………