GST Impact On Transportation of Goods

Composite Supply

What is Composite Supply? A supply naturally bundled in the course of business, consisting of:

One or more goods/servicesService + GoodsPrincipal Supply (Essentiality concept) – Tax rate is determined based on such supply.Ex: Loading/unloading + storage + Logistics services

Why is it essential?

The Software must be able to identify a service, which has more than 1 service.Operations personnel must understand the concept of Principal Supply, as it must be decided by a person who has experience in the logistic sector.The rate at which the service is taxable, and the classification is dependent on above.If possible, streamline the sub-heads in the revenue line to ease such above procedure

Mixed Supply

What is Mixed Supply? A two or more supplies provided at a single price, which is not a composite supply. Ex: ‘All in 1’ pricing mechanism, may be avoided. Taxability – GST shall be payable on entire value at the highest rate applicable for service forming part of the mixed supply. Any consequences?

A single price is keyed in for various services provided. The Software may not be able to distinguish the same from a standalone service.Operations personnel must understand the concept of Composite Supply and its relation to Mixed Supply.Taxable at the highest rate applicable from the various services provided.Suggested to convert such transactions into Composite supply in GST

Classifications Possible- Rate

Hiring of Vehicle/ Renting? – 28%Leasing of vehicle – 28%Transporter ( Lorry owner/ operator) – nilGTA – in relation to transport + Consignment note issued – 5% + RCMCourier – 18%Storage & Warehousing – 18%Packing – 18%Logistics , Freight Forwarders – 18%Business Support?- 18%

Transportation- goods – Exemptions

Entry 7 of Not. 12/17 – Govt also liable for transportation of goods to entity upto 20 Lakhs – No conditionEntry 8 – Govt to another govt – Liable for sameEntry 9 – Govt services upto 5K – LiableE 18 – Transportation other than GTA or courier –NilE 21- agricultural produce, less than 1500 or 750 or milk, salt, food grain including flour, pulses and rice.or organic manure, newspaper, defense/ militaryE 22 – Hiring to STC or GTA – Nil

Other Aspects

Rate – 5% without ITC – forward chargeReverse Charge – GTA to factory, society, co-operative, regd under GST, partnership + Aop, Casual Taxable person. – No need to register but enroll and file ENR-1??Difference b/n GTA & TransporterWhether B2B- whether credit available?Whether B2C – whether credit available?What about hamali, storage, packing in course?Logistic provider engaging GTA? Credit

Difference B/n Transporter & GTA/ Courier

One does not issue Consignment note which can be endorsed ( negotiable) : Auto- intra city movement, daily/ weekly bill issuedDoor to door express cargo service ( pick up & drop to specific location + time commitment. Thin line

Difference b/n hiring & transfer

Hiring = with driver – risk of vehicle with the owner – 18%Transfer of right = Give for some time- daily/ weekly/ monthly – Rate as applicable to truck – 28%

Place of Supply – Transporters

When Service Provider (SP) & Recipient of Service (RS) are within India:

Place of Supply (POS) – International

Recipient of Service is outside India:

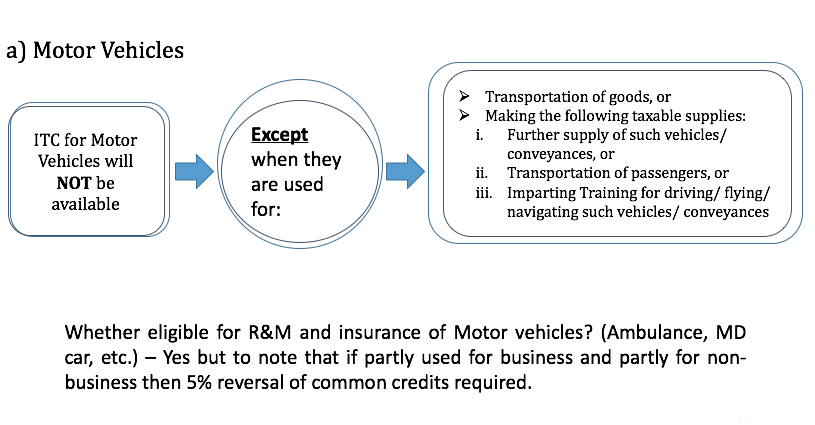

Restriction on ITC

Calculate Additional Credit

Vehicle cost – 5 L – GST 1.40 LakhsServicing & spares per year – 2 Lakhs – 0.40 LakhsLubricants – 10 Lakhs – 2.80 LakhsBank etc 2 Lakhs – 0.40Reduced cost of Diesel- open now- Crude around $45

Per truck – 1st year – 6.20 Lakhs loss

Who can avail the credit?

Trader/ ImporterManufacturerService providerCHAFreight ForwarderGTA services availed and passed on with margin. Can 2 issue GTA?

Who cannot avail the credit?

Unregistered DealerExempted Goods/ Service providers: Educational/ Health Care/ Government/ ReligiousExporters ,SEZ, EOUs will have to go for refund

Impact on Business

Erosion of large un-organized players but Large investments, FDI’s & stiff competition expected from organized playersCustomer Perception as benefit to industry – Anti-profiteeringConsolidation of warehouses – Central warehousing / Larger facilities to be establishedExisting warehouses to be shifted to more strategic locations due to changed business scenarioHigher logistics preference due to removal of warehousesMore transportation time due to check post delays being avoidedEligibility of VAT credits on vehicle/capital goods used for movement of goodsRelations & compliance of vendors & customersAviation Fuel, Petroleum products outside GSTWidened Tax baseFor ex: Imports &Exports billed in IndiaIncrease in rate of TaxRegistration, Returns, Matching principle & Invoicing challenges

Areas of Issues

GTO also must be brought within the Tax Net – No distinction between GTA & GTO – similar tax treatment for bothLaw relating to E-Way bills must be easedClear distinction between GTA and Courier services to avoid disputes in GSTBack door state trade barriers must be avoided – Permits must be online and hassle freeAccidental Damages – Earlier not includible in valueIncrease in Rate of Tax

RCM Liability

Presently 5-7% is minor costs incurredRTO checkpostSnacksMaintenanceRepairHamaliRent for stop/ hotel…many many more

Impact on Logistics – Road

Impact on Supply Chain Management

Impact on Freight Forwarding

Impact on Package Handling

Restructure for B2B with credit & B2B – no credit + exempted products

Two EntitiesNew Vehicles in A – new entity

GTA service taken & passed on

Freight Forwarder, Logistics for Exporter, B2C, B2B no credit ( power, education, healthcare….

GTA – 30% & 40% in case of used household goods) Goods in Container – 40% Courier – 100% End to End Package – 100%

If advances received – on receipt If advances received – on receipt In International

(a)GTA – Place of location of the payer of freight; (b)Courier – Place of performance; (c)If SP & SR located in TT – location of recipient

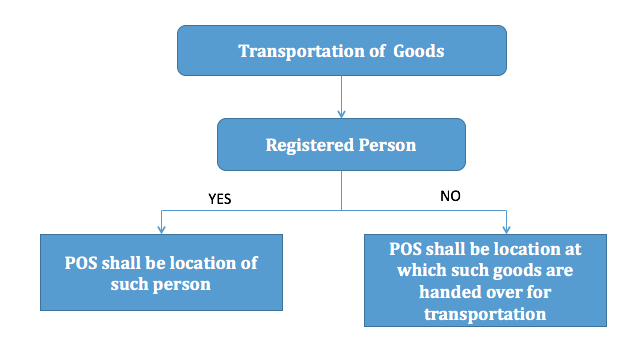

(a)Registered person – Location of such person (b)Other than Regd Person – Location where goods are handed over for transportation

In International

(a)GTA – Place of Destination; (b)Courier – Place of Performance; (c)If SP & SR located in TT – location of recipient

If advances received – on receipt

Receipt of Consideration/advance, Issue of invoice 31st Day from completion of service

International – Location of immovable property If advances received – on receipt If advances received – on receipt

Supply to registered person: Location of service recipient. Can be identified based on GSTN of recipient. Supply to unregistered person: “Address of recipient on record of company” – There may be no such cases

If advances received – on receipt

Receipt of Consideration/advance, Issue of invoice Completion of service

International – No cases

Supply to registered person: Location of service recipient. Can be identified based on GSTN of recipient. Supply to unregistered person: “Address of recipient on record of company”

A. As pure agent ( no margin)B. As margin adder – Use of consignment note of passer on?

Specific Issues – Interactive Discussion

Delegates issues……..Revised BGM — August Middle?Faculty Identification Program – August 2017?Further questions – pdicai.orgOnline certificate course availableGST evaluator, member of group…..

Recommended Articles

GST LoginHSN Code ListGST RegistrationGST FormsGST Invoice RulesReturnsGST Anti profiteeringLegal ProvisionsGST Reverse Charge