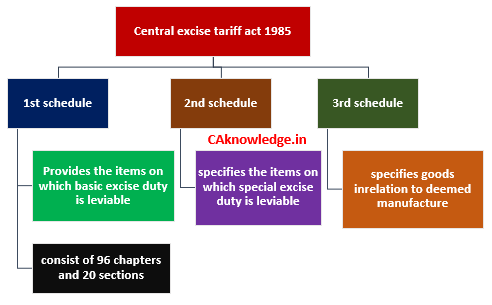

Central excise tariff act 1985 is based on “Harmonized system of Nomenclature”. Now you can scroll down below n check more details for “Classification of Excisable Goods, Various Types of Excisable Goods”

Classification of Excisable Goods, Various Types of Excisable Goods

Harmonized system of Nomenclature:

This is a system of product coding which is accepted internationally as a part of the GATT (General Agreement on Trade & tariff) initiatives. This acts as universal economic language and code for goods. This was developed by the World Customs Organization (WCO). In this system Headings, sub headings and related numerical codes, chapters and schedules are used to classify the goods. It brings harmonization of Customs and trade procedures across the globe.

Meaning of various terms used in classification:

- Section: A Section consists of many chapters and sub chapters which represent a group of goods.

- Chapters: A chapter contains goods of a particular class beginning with raw materials and ending with. All the items relating to the same industry and all the items obtained from the same raw materials are covered by one chapter.

- Chapter notes: At the top of every chapter these are mentioned having statutory backing.

- Heading: Depending upon the type of goods within a same class in every chapter headings are given to denote a particular type of goods.

- Sub-Heading: Each heading is divided into various sub-headings.

Arrest and Bail Under Service Tax and Excise NotesDownload Latest Central Excise Forms – UpdatedAmendments in Cenvat Credit and Excise for Nov 2015

- Interpretation and general explanatory notes: For the purpose of interpreting 1st schedule interpretation rules (6 rules) have been provided along with the general explanatory notes (2 rules). Central excise tariff act, 1985 has been broadly picturized into 3 schedules as given below:

- First schedule: This schedule specifies the list of items on which basic excise duty is to be levied. It consist of 96 chapters and 20 sections providing the rates of basic excise duty to be levied for various goods.

- Second schedule: This schedule specifies the items on which special excise duty is to be levied. (from 01-03-2006 special excise duty has been exempted on all goods).

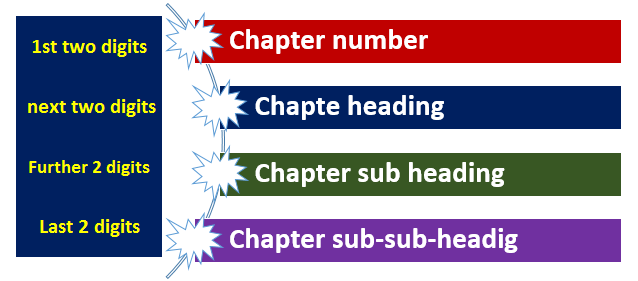

- Third schedule: This schedule determines the status of various goods as deemed manufactured in relation to various activities such as packing, labeling, repacking, MRP alteration which render them marketable thus amounting to manufacture. Excisable goods are classified using a 8 digit code system in which the digits are interpreted as follows:

- First 2 digits: These two digits denote the chapter number under which that item is covered.

- Next two digits: They indicate the heading of the goods in concerned chapter.

- Further two digits: They refer to the chapter sub-heading of that item.

- Last 2 digits: These two denote the sub-sub-heading of the chapter