There are Many Queries Related to CA New Course Like – ca new syllabus 2017, CA IPCC May 2017 New Syllabus, CA IPCC Nov 2017 New Syllabus. When New course is applicable, how to download New study material, ca new syllabus 2017 applicability, CA new Course, CA New Syllabus for CPT, CA New Syllabus for IPCC and CA Final here we are providing complete solution of above queries. If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing ”freely“ Implementation of Revised Scheme of Education and Training for CA Course w.e.f. 1st July, 2017. – (27-05-2017) Sub: Implementation of Revised Scheme of Education and Training for CA Course w.e.f. 1st July, 2017. All concerned are hereby informed that the Revised Scheme of Education and Training for CA course will come into effect from 1st July, 2017. Students who are eligible to register in the CPT/IIPCC/Final under the existing scheme, may register on or before 30th June, 2017. With effect from 1st July, 2017, the registration in the CPT/IIPCC/Final under the existing scheme will discontinue. The Revised Scheme will be made available shortly at www.icai.org

CA New Syllabus 2017 CPT, IPCC, CA Final New Course 2017

The Institute of Chartered Accountants of India (ICAI) has formulated the Revised Scheme of Education and Training in lines with International Education Standards issued by International Federation of Accountants (IFAC) after considering the inputs from various stakeholders. The Revised Scheme of Education and Training for CA course will come into effect from 1st July, 2017. The Scheme of the Course is available at https://resource.cdn.icai.org/45556bos35643summary.pdf Further, below is the implementation schedule depicting the information regarding the last date of registration under Existing Scheme, date of commencement of registration under Revised Scheme, last exam at all levels under Existing Scheme and the number of parallel attempts of examinations at all levels under both Exiting and Revised Scheme. Please note detailed paper wise exemption plan will be notified in due course.

Implementation schedule of Revised Scheme of Education and Training

A. CA Foundation Course Applicability

CA IPCC New Course Applicability

CA Final New Course Applicability

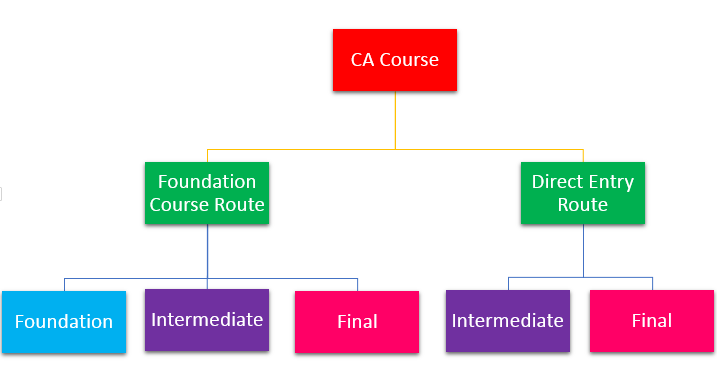

Route I – Foundation Course Route

Under the Foundation Course Route, a Class X pass student may register itself with the Board of Studies (BoS) of the Institute for the Foundation Course. The steps are as follows:

Register with Board of Studies (BoS) after appearing in Class XII examination so as to complete four months study period (i.e. register till 30th June / 31st Dec. for November/May Examination).Qualify Class XII examination (if not done earlier)Appear for Foundation examination in November/May.Qualify Foundation Course.Register with the BoS for the Intermediate CourseComplete 8 months of study course.Appear and Pass in either or both Groups of Intermediate Course.Successfully complete Four Weeks Integrated Course on Information Technology and Soft Skills (ICITSS) anytime after registering for Intermediate Course but before commencement of the Practical Training.Register for three years Practical Training on passing either or both the Groups of Intermediate Course.Register for the Final Course after qualifying both the Groups of Intermediate Course.Successfully complete Four Weeks Advanced Integrated Course on Information Technology and Soft Skills (AICITSS) during the last two years of Practical Training but before appearing for Final Examination.Appear in Final examination during last six months of practical training. • Complete Practical TrainingQualify both groups of Final Course.Become Member

Route II – Direct Entry Route

The ICAI allows the following students to enter directly to its Intermediate Course: A. Commerce Graduates/Post-Graduates (with minimum 55% marks) or Other Graduates/Post-Graduates (with minimum 60% marks) and B. Intermediate level passed students of Institute of Company Secretaries of India and Institute of Cost Accountants of India

A. Steps for eligible Graduates and Post Graduates:

Register with the BOS for the Intermediate course (provisional registration allowed to the students doing Final year of graduation).Successfully complete Four Weeks Integrated Course on Information Technology and Soft Skills (ICITSS) before commencement of the Practical Training.Register for Three Years Practical Training.Appear in Intermediate Examination after Nine months of Practical TrainingQualify Intermediate Course.Register for the Final Course after qualifying both Groups of Intermediate Course.Successfully complete Four Weeks Advanced Integrated Course on Information Technology and Soft Skills (AICITSS) during the last two years of Practical Training but before appearing for Final Examination.Appear in Final examination during last six months of practical training.Complete Practical Training.Qualify both groups of Final Course.Become Member

B. Steps for eligible students who have passed Intermediate level examination of Institute of Company Secretaries of India or Institute of Cost Accountants of India:

Register with the BoS for the Intermediate Course.Complete 8 months of study course.Appear and Pass in either or both Groups of Intermediate Course.Successfully complete Four Weeks Integrated Course on Information Technology and Soft Skills (ICITSS) anytime after registering for Intermediate Course but before commencement of the Practical Training.Register for Three years Practical Training on passing either or both the Groups of Intermediate Course. Register for the Final Course after qualifying both the Groups of Intermediate Course.Successfully complete Four Weeks Advanced Integrated Course on Information Technology and Soft Skills (AICITSS) during the last two years of Practical Training but before appearing for Final Examination.Appear in Final examination during last six months of practical training.Complete Practical TrainingQualify both groups of Final Course.Become Member.

CA Foundation Course

Number of Papers – 4 ]Paper 1: Principles and Practices of Accounting (100 Marks) Paper 2: Business Law & Business Correspondence and Reporting (100 Marks)

Section A: Business Law (60 Marks)Section B: Business Correspondence and Reporting (40 Marks)

Paper 3*: Business Mathematics and Logical Reasoning &Statistics (100 Marks)

Part I: Business Mathematics and Logical Reasoning (60 Marks)Part II: Statistics (40 Marks)

Paper 4*: Business Economics & Business and Commercial Knowledge (100 Marks)

Part I: Business Economics (60 Marks)Part II: Business and Commercial Knowledge (40 Marks)

Notes:

*Paper 3 and Paper 4 will be Objective type papers with negative markingPassing percentage: Aggregate- 50% and Subject-wise- 40% at one sitting.

CA Intermediate Course

Number of Papers – 8 Group I Paper 1: Accounting (100 Marks) Paper 2: Corporate Laws & Other Laws (100 Marks)

Part I: Company Laws (60 Marks)Part II: Other Laws (40 Marks)

Paper 3: Cost and Management Accounting (100 Marks) Paper 4: Taxation (100 Marks)

Section A: Income Tax Law (60 Marks)Section B: Indirect Taxes (40 Marks)

Group II Paper 5: Advanced Accounting (100 Marks) Paper 6: Auditing and Assurance (100 Marks Paper 7: Enterprise Information Systems & Strategic Management (100 Marks)

Section A: Enterprise Information Systems (50 Marks)Section B: Strategic Management (50 Marks)

Paper 8: Financial Management & Economics for Finance (100 Marks)

Section A: Financial Management (60 Marks)Section B: Economics for Finance (40 Marks)

CA Final Course

Group I

Paper 1: Financial Reporting (100 Marks)Paper 2: Strategic Financial Management (100 Marks)Paper 3: Advanced Auditing and Professional Ethics (100 Marks)Paper 4: Corporate and Economic Laws (100 Marks) Part I: Corporate Laws (70 Marks) Part II: Economic Laws (30 Marks)

Group II

Paper 5: Strategic Cost Management and Performance Evaluation (100 Marks)Paper 6: Elective Paper (100 Marks) (One to be chosen from the list of Elective Papers)

Elective Papers

Risk ManagementInternational TaxationEconomic LawsFinancial Services & Capital MarketsGlobal Financial Reporting Standards Multidisciplinary Case Study

Paper 7: Direct Tax Laws (70 Marks) & International Taxation (30 Marks)

Part I: Direct Tax Laws (70 Marks)Part II: International Taxation (30 Marks)

Paper 8: Indirect Tax Laws (100 Marks)

Part I: Goods and Service Tax (75 Marks)Part II: Customs and FDP (25 Marks)

Four Weeks Integrated Course on Information Technology and Soft Skills (ICITSS) (in replacement of Orientation Course & Information Technology Training) Duration: 4 weeks (2 weeks for soft skills and 2 weeks for IT) When to complete: Students registering for the Intermediate course shall be required to successfully complete ICITSS before commencement of practical training.

Practical Training (Articleship Training)

Duration of Practical Training: Three YearsCommences after completing Integrated Course on Information Technology and Soft Skills (ICITSS) and passing either or both groups of Intermediate.For direct entrants coming through Graduation and Post Graduation route, the practical training commences immediately after they complete four weeks ICITSS.For direct entrants who have passed Intermediate level examination of Institute of Company Secretaries of India or Institute of Cost Accountants of India, the practical training commences immediately after completing Integrated Course on Information Technology and Soft Skills (ICITSS) and passing either or both groups of Intermediate

Advance Four Weeks Integrated Course on Information Technology and Soft Skills (AICITSS) (in replacement of General Management and Communication Skills(GMCS) & Advanced Information Technology Training) Duration: 4 weeks (2 weeks for soft skills and 2 weeks for Advance IT) When to complete: Students undergoing Practical training shall be required to do AICITSS during the last 2 years of Practical training but to successfully complete the same before being eligible to appear in the Final Examination. The students will be tested on “Information System Risk Management and Audit” under AICITSS. The students would be tested through online test paper/ OMR Test Paper conducted by the examination department which they would be required to qualify to be eligible to appear for Final Examination. Recommended Articles If you have any query regarding “CA New Syllabus” then please tell us via below comment box….